Quantify the risk of Autonomous Vehicle deployments

Reliable, transparent, and evidence-based risk scoring of AV deployments around the world.

Underwrite AV risk with evidence-based scoring

Accurate and consistent risk assessment is fundamental for effective underwriting. Simulytic helps insurers price AV policies with reliable and transparent risk scoring.

-

01.

Driving risk insights for your AV policy needs

Set insurance premiums with our driving risk score that accounts for 1st and 3rd party bodily injury and property damage liabilities, pre- and post-bind assessments, as well as primary and excess lines.

-

02.

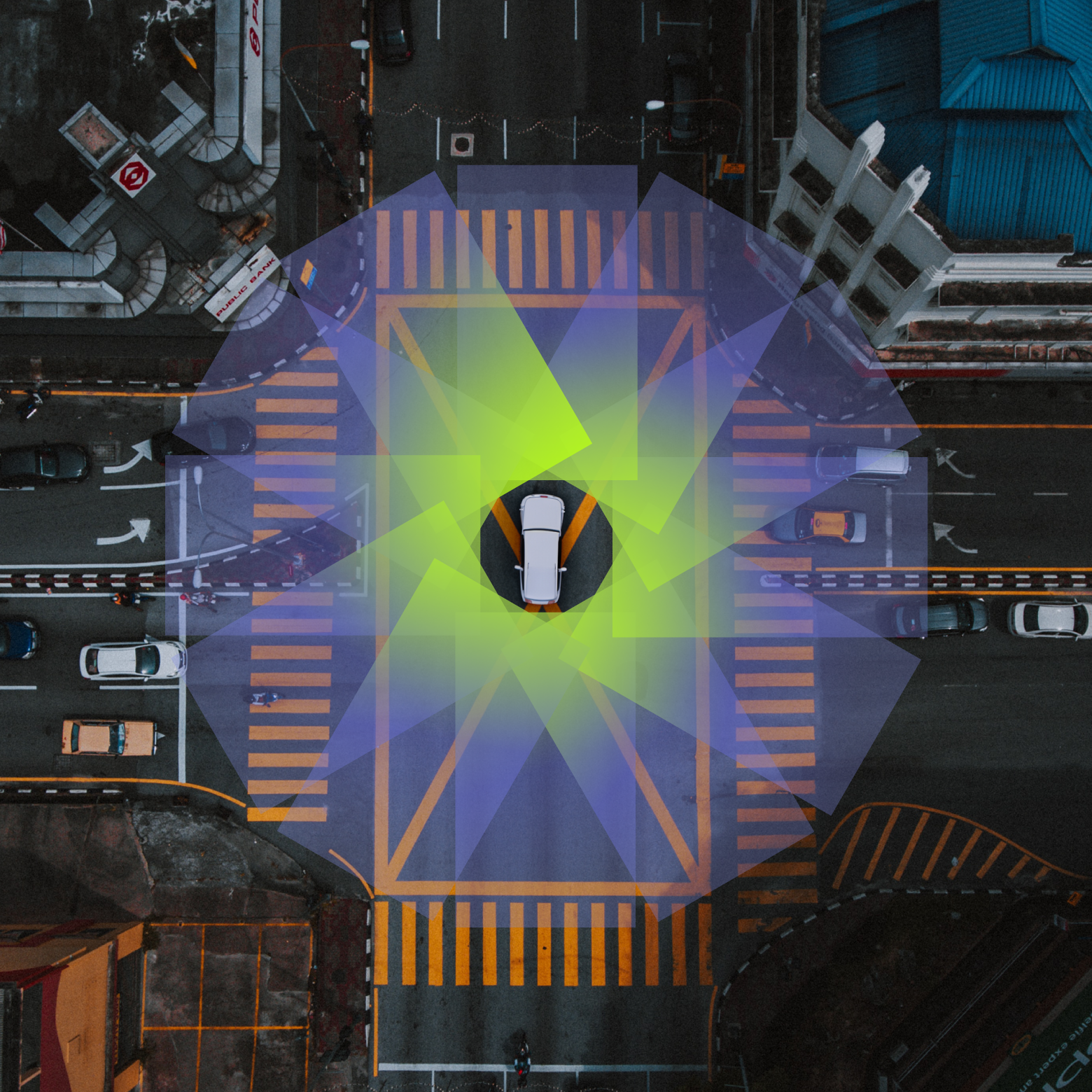

Hyperlocal risk scoring, specific to the AV deployment

Shed light on the driving risk of an AV deployment with our synthetic driving history that accurately reflects the AV operating in the local environment and for the particular use case.

-

03.

Continuously updated risk assessment for AV scaling

Update insurance premiums and policy conditions based on a software driver and deployment conditions that are continuously being updated – without the need to integrate IP-sensitive AV technology.

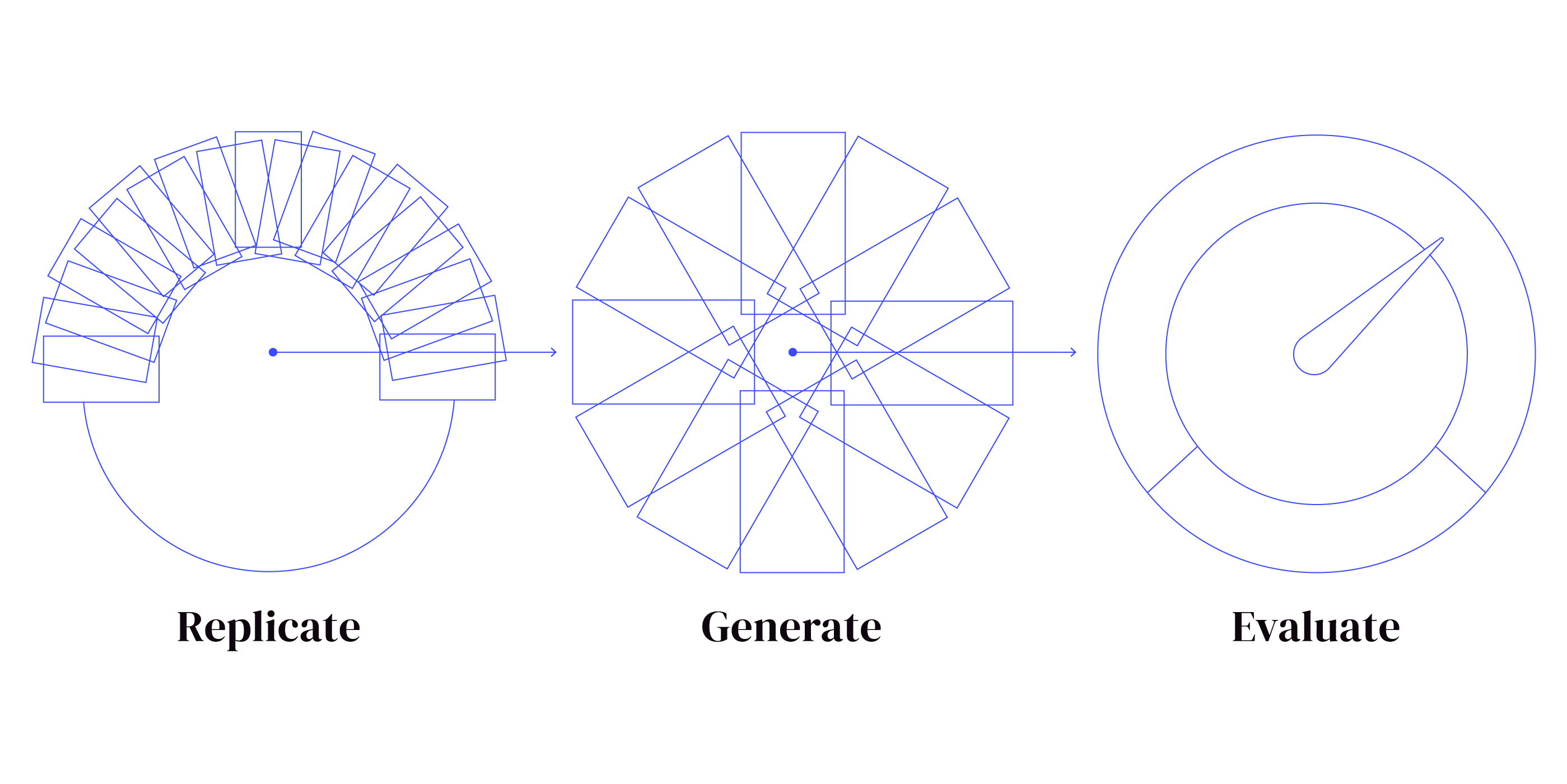

Our patented methodology is tailor-made for AV insurance

Simulytic is dedicated to bridging the worlds of Autonomous Vehicles and Insurance. Our approach goes beyond isolated scenario testing to unlock comprehensive AV exposure insights. We focus on your perspective as an insurer and the distinct needs of your Autonomous Vehicle clients.

Applications in Autonomy

Find out how innovative insurers are using Simulytic to tap into the growing premium pool for all types of Autonomous Vehicle deployments. Armed with our insights, underwriters can capitalise on the new opportunities.

Moving people

Robotaxis

Robotaxis operate in dense urban environments, where the high frequency and complexity of interactions with the environment and other road users present significant challenges. As robotaxis expand in cities and highways, our tailored approach ensures that the insights from our analysis continuously support the growth of robotaxi networks.

Passenger shuttles

Autonomous shuttles move people through urban centers, campuses, residential communities, and more. Driving risk in these environments depends on the complexity of the roads and the types of interactions with people and other vehicles. Our hyperlocal risk insights enable insurers to tailor the conditions and pricing of an AV shuttle insurance policy to these specific deployment conditions.

Moving goods

Long Haul freight

Long-haul trucking covers extended routes across highways and interstates, where risks are influenced by high speeds, variable weather, and unique road conditions. As the industry evolves and expands its reach, our focused analysis offers crucial foresight into managing risks and supporting expansion through relevant policy provisions.

Middle Mile logistics

Transporting goods between distribution centers and local hubs, often across fixed suburban and semi-urban routes, presents insurers and operators with an opportunity to user our platform to optimise the risk profile of the delivery schedule, route and operating restrictions.

Last Mile delivery

Last-mile delivery services operate in varied urban and suburban settings. Our hyperlocal analysis helps ensure that insurance coverage is finely tuned to address the risk of a particular operation.

Our customers, partners, and awards